Publication

Updated:

Companies considering their risk officer for a C-suite position spiked from a low of 29% in 2022 to 45% in 2024.

Unpredictability around policy direction and regulation across major economies is forcing businesses to adopt a ‘wait-and-see’ approach.

As the undeniable impacts of climate change impact businesses, environmental risks are being tackled with increasing proactivity and urgency.

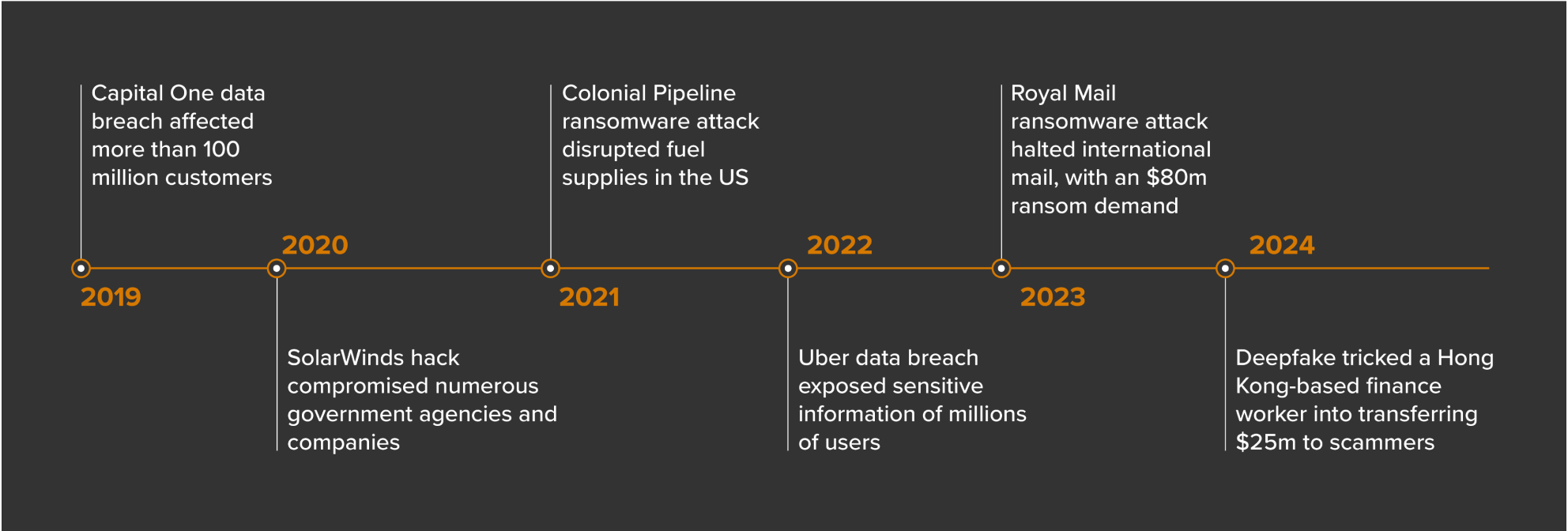

As companies fortify against direct cyber and financial risks, they may be overlooking the broader economic vulnerabilities in our interlinked digital-financial ecosystem.